Douglas County Tax Sale 2025. Sales tax rates are determined by exact street address. Po box 218 minden, nv 89423 ph:

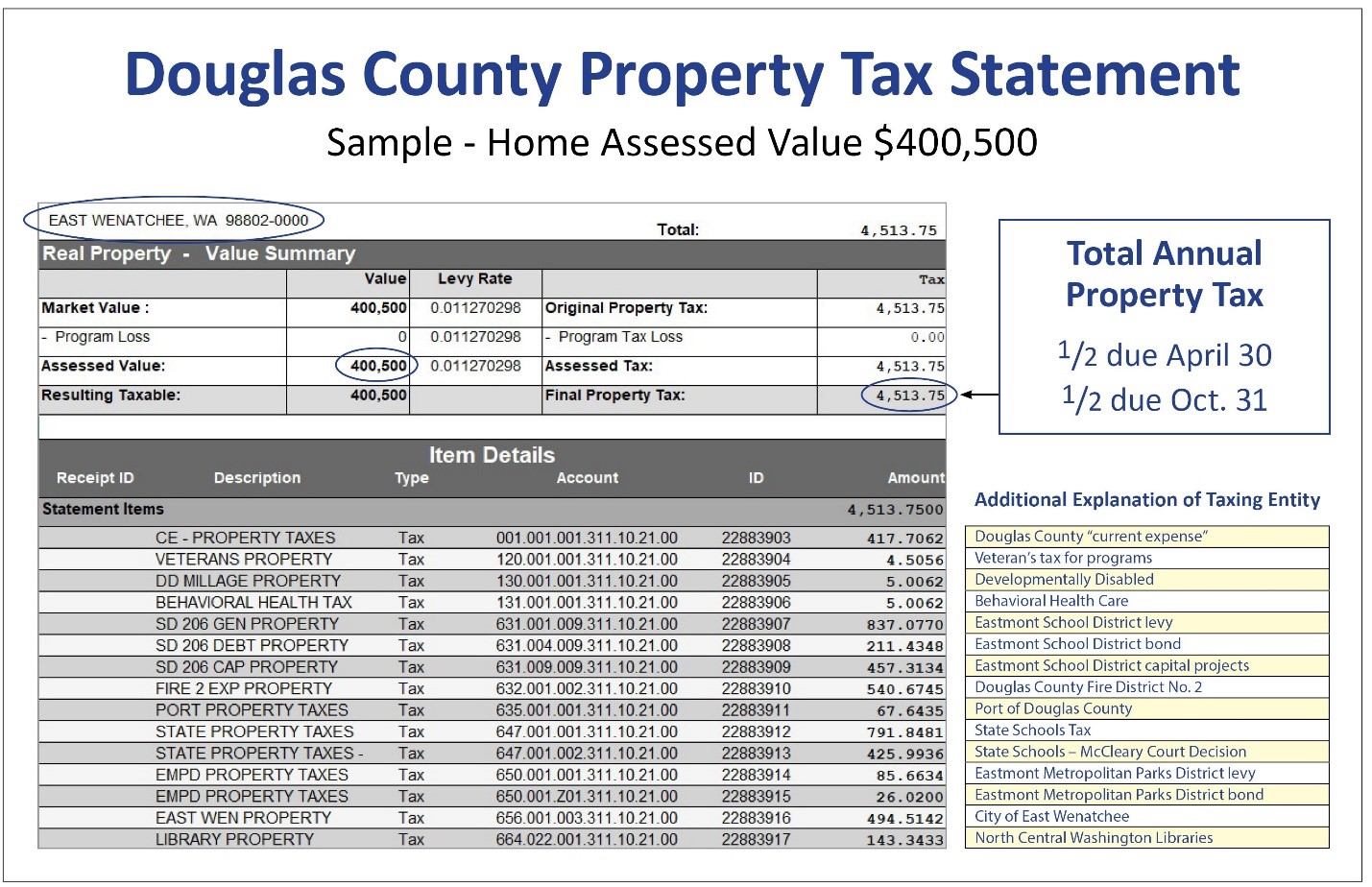

We do not mail property tax notices to mortgage companies. The office is also responsible for the receipting and distribution of all county revenues, and the administration of banking and investment activities.

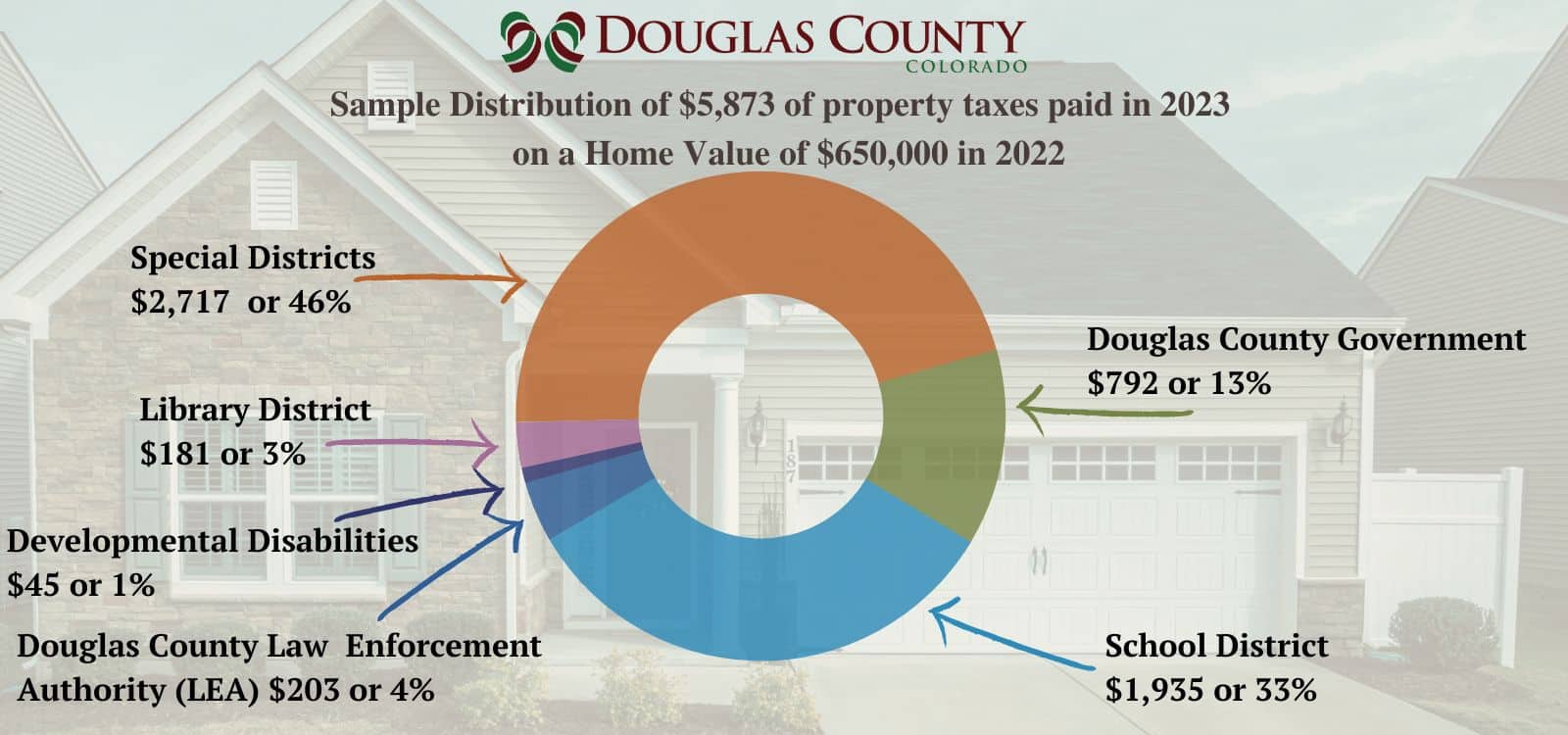

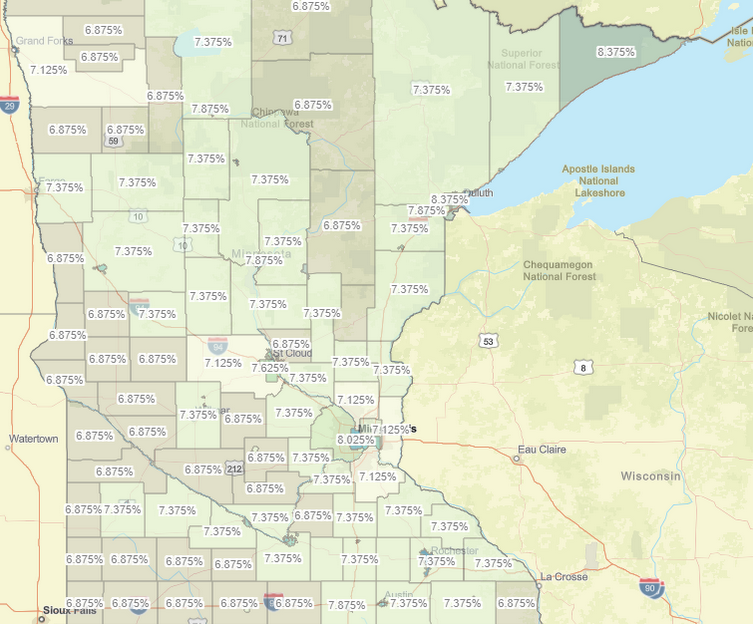

What’s happening with property taxes? Douglas County, When is my delinquent property eligible for tax sale? Douglas county tax jurisdiction breakdown for 2025.

A closer look into our property tax system, 26 tax bill to the county treasurer and then. Real estate properties are eligible for foreclosure proceedings 2 years and 10 months after the property has been.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, The treasurer’s office mails tax statements/postcard notifications in january. Delinquent lists february 12, 2025.

Monday Map Combined State and Local Sales Tax Rates, The treasurer’s office mails tax statements/postcard notifications in january. Real estate properties are eligible for foreclosure proceedings 2 years and 10 months after the property has been.

.png)

2025 Property Tax Notifications arriving now Douglas County, Look up 2025 sales tax rates for douglas county, missouri. Real estate properties are eligible for foreclosure proceedings 2 years and 10 months after the property has been.

Tax Commissioner Douglas County Tax, After the due date for tax payments has expired, the levying officer shall notify each delinquent taxpayer in writing that the taxes are outstanding, and if taxes are. Sales tax rates are determined by exact street address.

Douglas County Property Tax Contesting Information, Tax cap — frequently asked questions. What does this sales tax rate breakdown mean?

Minnesota Sales Tax Guide, We do not mail property tax notices to mortgage companies. Your 2025 property tax bill, from the county treasurer, lists the multiple taxing authorities serving your home including douglas county, school district, fire districts, metro.

There's a new location for paying Douglas County property taxes, How property taxes are calculated; Our county commissioners have stepped up and created a property tax reduction of 3.679 mills, called a property tax reserve fund, that will be rebated to our property taxpayers.

_binary_7225103.jpg)

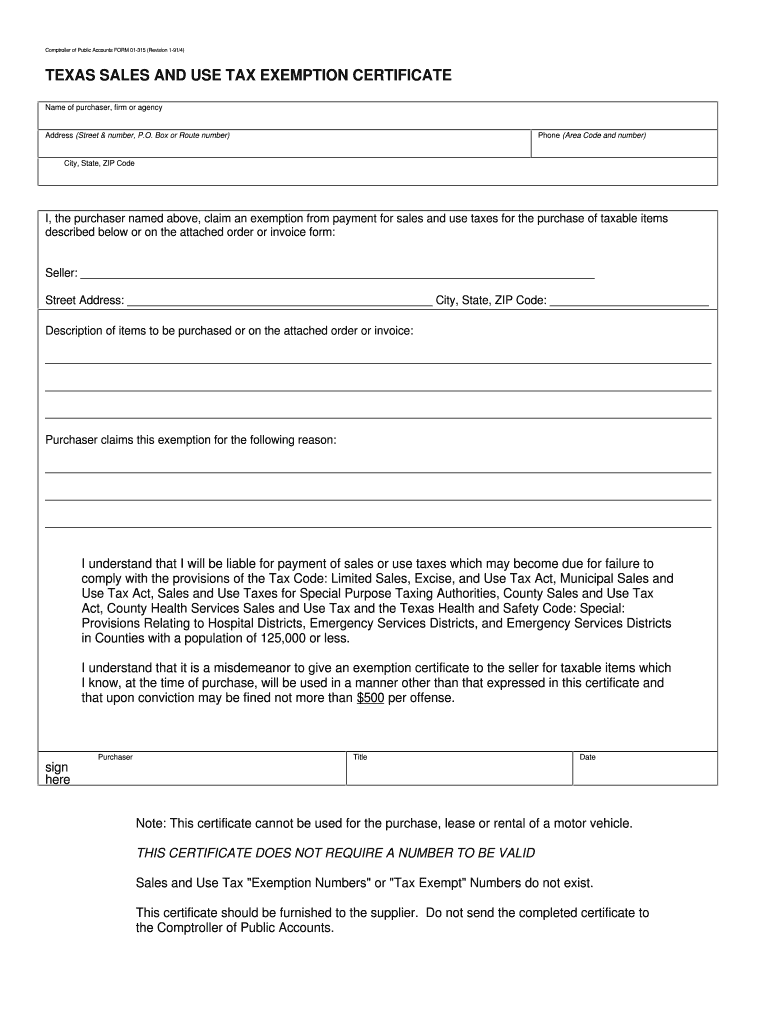

Texas Tax Exempt PDF 19912024 Form Fill Out and Sign Printable PDF, Delinquent property tax sale faqs. 26 tax bill to the county treasurer and then.