Ca Inheritance Tax 2025. If you received a gift or inheritance, it should not be included in your income. If you received a gift or inheritance, do not include it in your income.

The california changes to tax assessment on inherited homes initiative is not on the ballot in california as an initiated constitutional amendment on november 5, 2025. California residents don’t need to worry about a state inheritance or estate tax as it’s 0%.

Since california is not a state that imposes an inheritance tax, the inheritance tax in 2025 is 0% (zero).

Tax rates for the 2025 year of assessment Just One Lap, One effective way to reduce your taxable estate and avoid inheritance tax is by gifting assets during your lifetime. The good news for beneficiaries in 2025 is that the tax implications are generally favorable.

how do i cancel my california estimated tax payments?, There is no federal inheritance tax and only six states. Proposition 19 was approved by california voters in the november 2025 election, and will result in significant changes to the property tax benefits californians.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, If you received a gift or inheritance, it should not be included in your income. Does california have an inheritance tax or estate tax?

Inheritance Tax Temple Bar Independent Financial Advice, Namely, the estate includes all your assets, such as your home, investments, savings,. Discover the essential aspects of california inheritance law in 2025 with our comprehensive guide.

Inheritance Tax Basics Edge Magazine, If you received a gift or inheritance, it should not be included in your income. If you are going to receive an inheritance from someone who lived in a state other than california, talk with your fiduciary financial planner to check the estate tax.

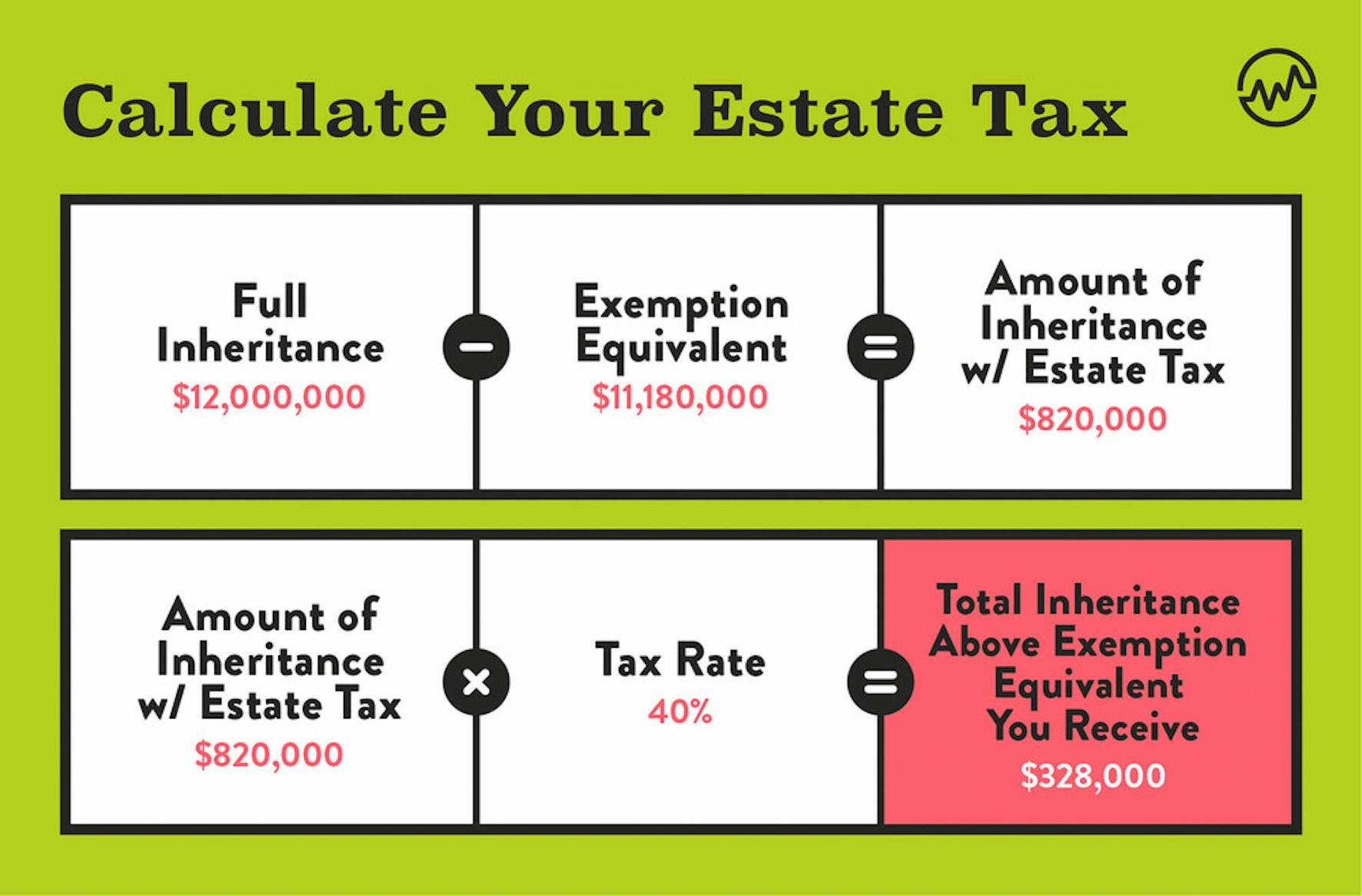

Inheritance Tax How Much Will Your Children Get? Your Estate Tax, Receiving an inheritance often prompts questions about tax liabilities. California’s unique approach to inheritance tax.

Inheritance Tax — YIM TAX, Namely, the estate includes all your assets, such as your home, investments, savings,. California’s unique approach to inheritance tax.

Inheritance tax waiver form california Fill out & sign online DocHub, The state controller's office, tax administration section, administers the estate tax, inheritance tax, and gift tax programs for the state of california. They may apply to you and your inheritance.

Getting to Grips with Inheritance Tax Monarch Solicitors, The california changes to tax assessment on inherited homes initiative is not on the ballot in california as an initiated constitutional amendment on november 5, 2025. They may apply to you and your inheritance.

Dealing with payment of inheritance tax when estate funds are inaccessible., California residents don’t need to worry about a state inheritance or estate tax as it’s 0%. They may apply to you and your inheritance.