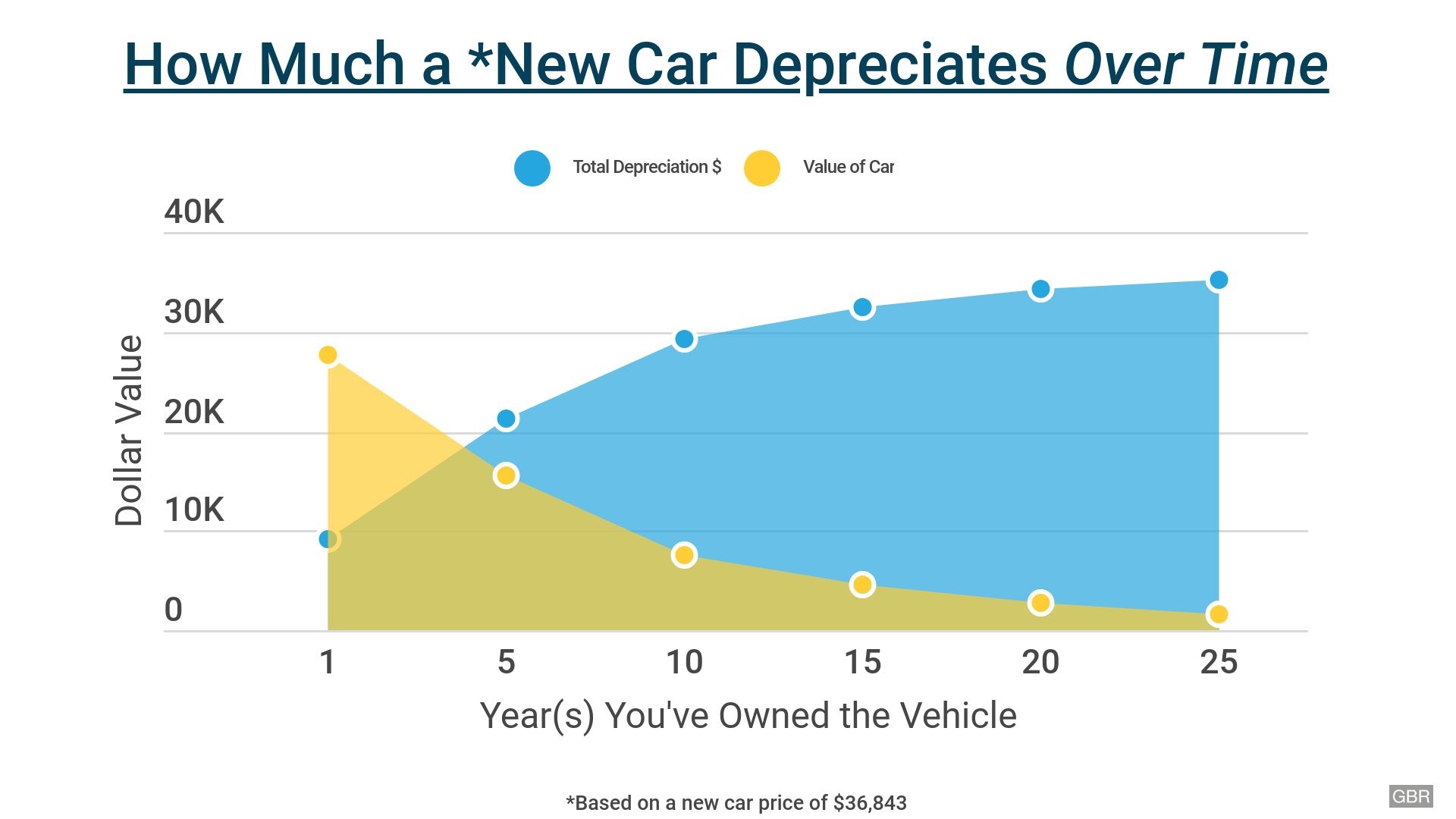

Bonus Depreciation 2025 For Vehicles. For passenger vehicles, trucks, and vans that are used more than 50% for business, the bonus depreciation limit was $18,100 for the first year for 2025. The tcja increased bonus depreciation to 100% through tax year.

This includes a cash discount of rs 25,000, an exchange bonus of rs 50,000,. These are the types of vehicles that, if used for business, might see a bump in the amount you can deduct for depreciation in 2025.

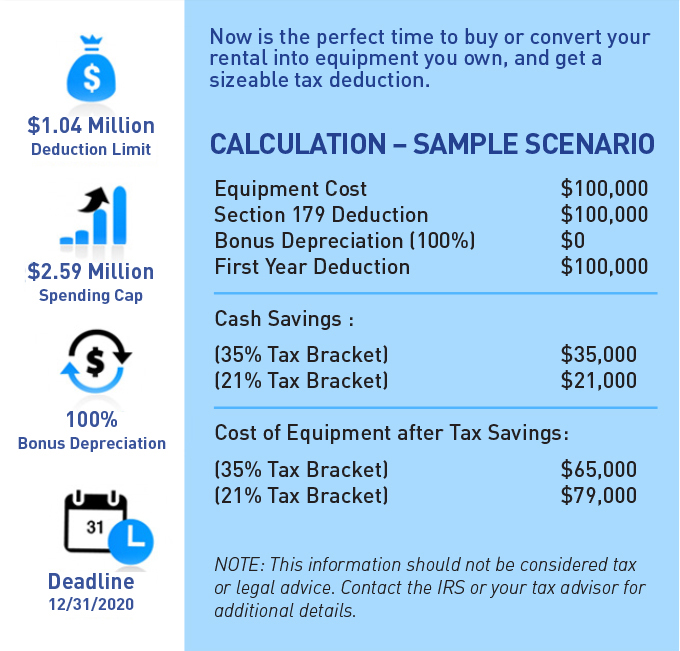

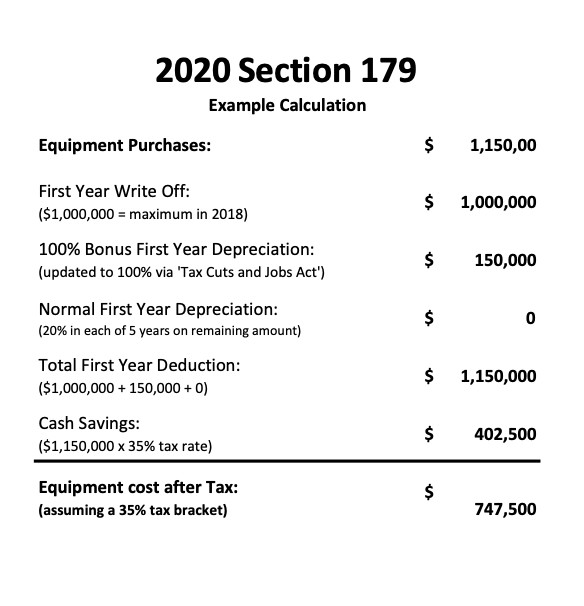

Bonus Depreciation Definition, Examples, Characteristics, The section 179 special deduction tax code (enacted by congress in 2015) allows businesses to write off up to $1 million dollars of depreciable assets, including. Prior to enactment of the tcja, the additional first.

Commercial truck depreciation calculator JeannieElli, These are the types of vehicles that, if used for business, might see a bump in the amount you can deduct for depreciation in 2025. Bonus depreciation is a valuable tax incentive that allows businesses to deduct a significant.

8 ways to calculate depreciation in Excel (2025), For suvs with a gvwr. Prior to enactment of the tcja, the additional first.

100 Bonus Depreciation for SUVs for Your Business YouTube, This strategy includes trucks, suvs, rvs, and even motorcycles. For more information, check out the.

Section 179 and Bonus Depreciation at a glance United Leasing & Finance, Tiago cng (mt + amt) gets rs. The biggest benefit of the current auto deduction is the strategy of bonus depreciation.

Car Value Depreciation How Car Specs, Tiago cng (mt + amt) gets rs. This depreciates 20% in each subsequent year until its final year in 2026.

Irs vehicle depreciation calculator BrookeNella, The tcja increased bonus depreciation to 100% through tax year. For 2025, businesses can take advantage of 80% bonus depreciation.

Depreciation Table Examples, A taxpayer may claim both the section 179 deduction and bonus depreciation. The real estate industry tends to be dynamic, but a spate of recent pivotal regulatory changes is making 2025 particularly important for real estate leaders charged.

Bonus Depreciation and Factory Incentives on Commercial Vehicles at, Download our free tax guide for individual filers. The biggest benefit of the current auto deduction is the strategy of bonus depreciation.

Bonus depreciation calculation example AdemolaJardin, This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,890,000.also, the maximum section 179. Bonus depreciation deduction for 2025 and 2025.