Are Entertainment Expenses Deductible In 2025. This deduction is set to expire in 2025. After tax reform, such expenses for amounts paid or incurred after dec.

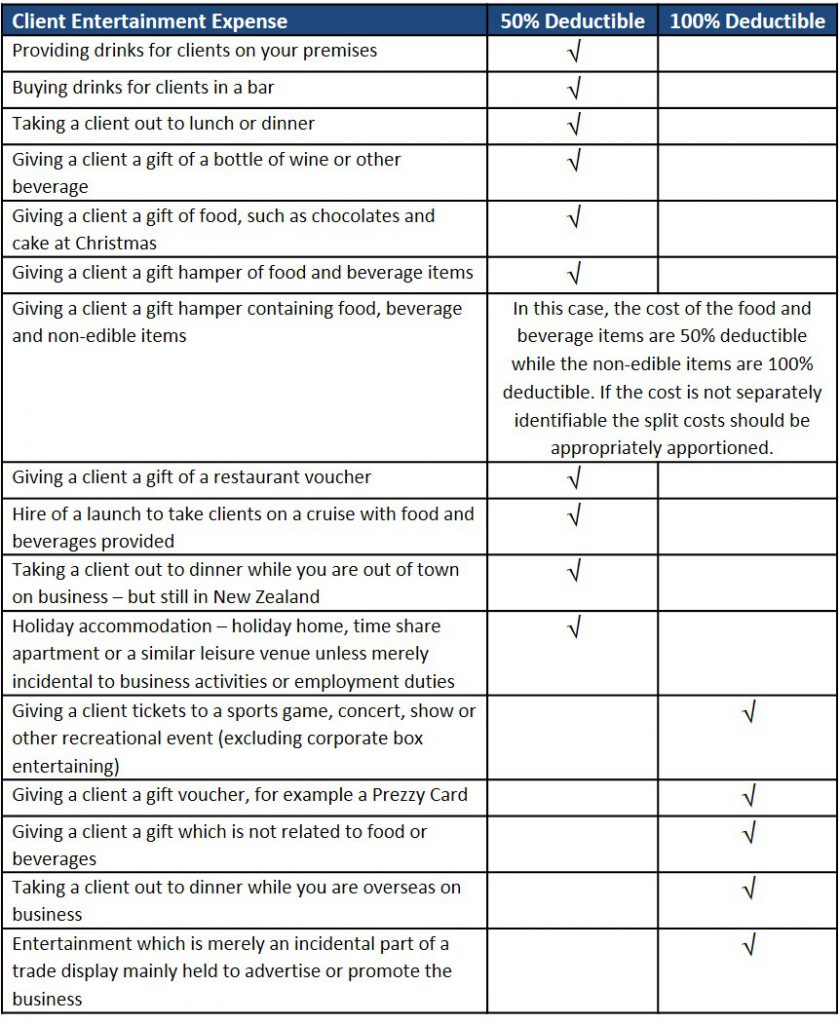

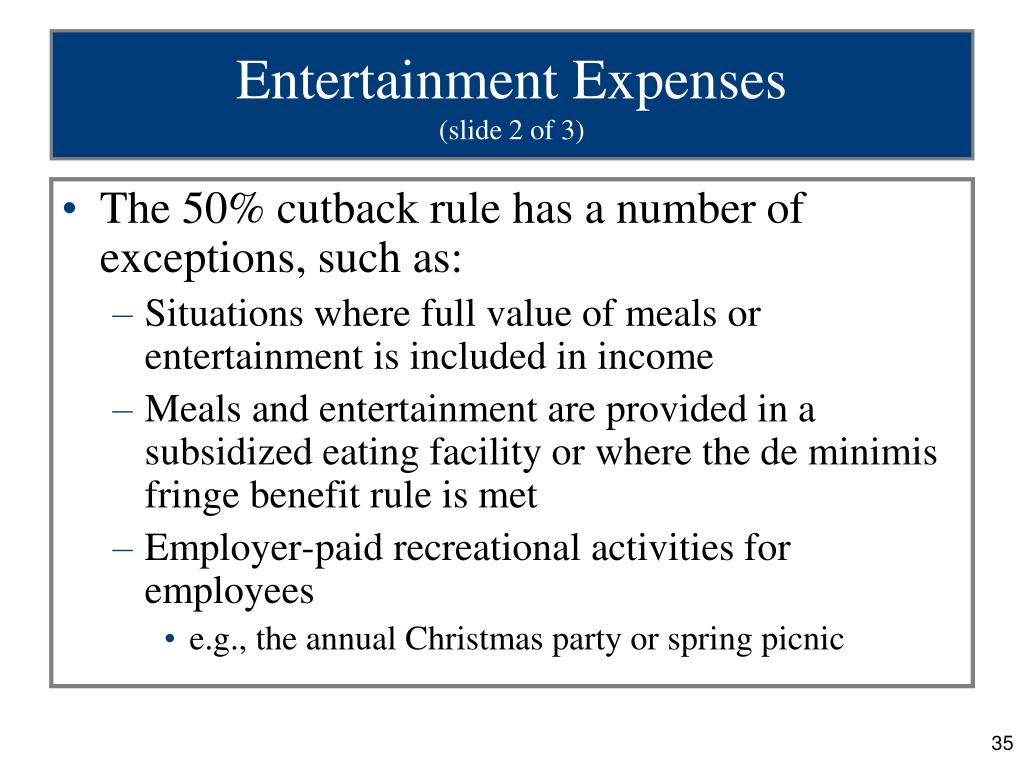

Here are some common examples of 100% deductible meals and entertainment expenses: The new tax regulations allow a 50% deduction on any entertainment, amusement, or recreation expenditure for the purposes of receiving customers,.

For tax year 2025, several of the meals and entertainment deductions revert back from one hundred percent deductibility to fifty percent deductibility.

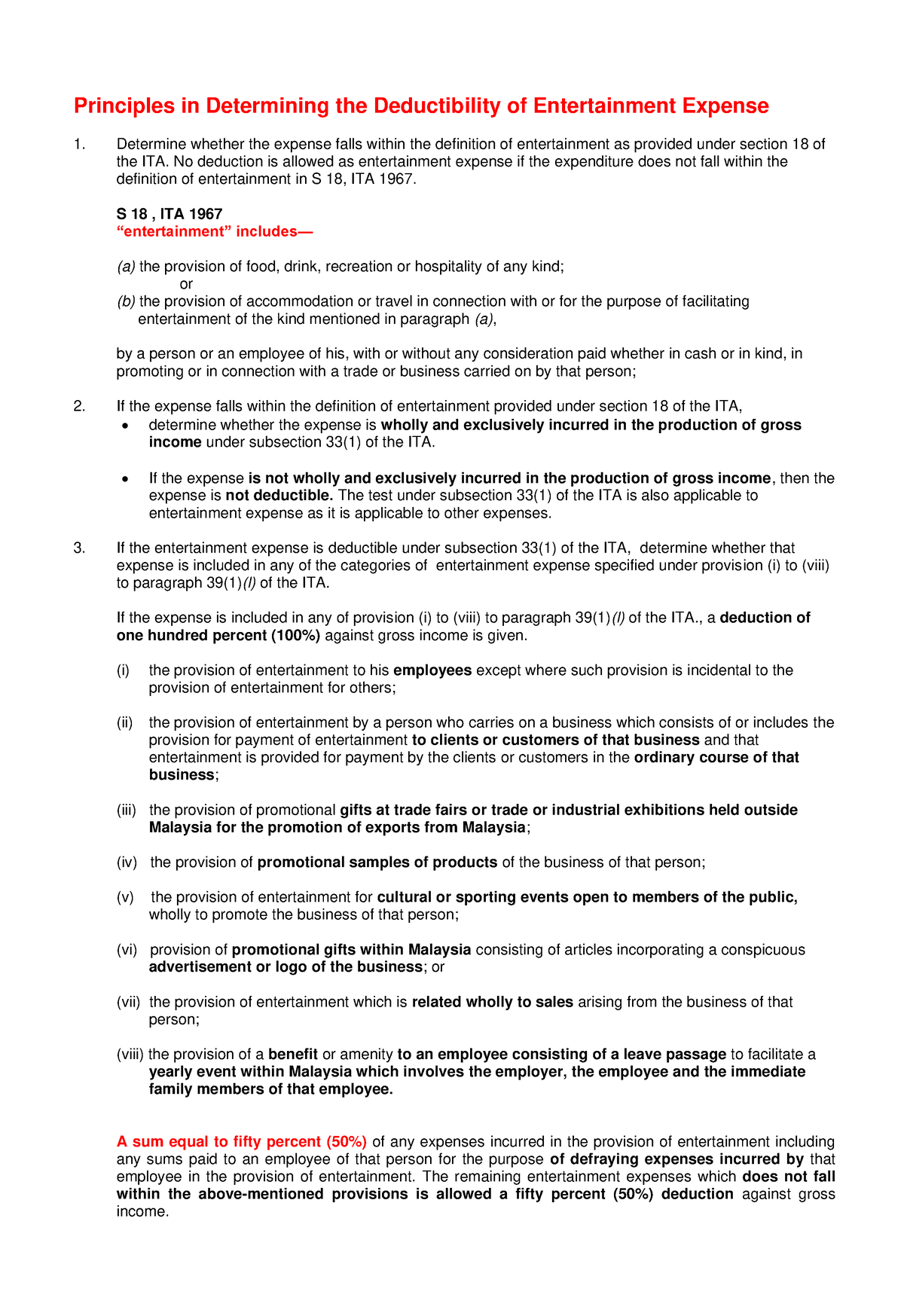

Entertainment Expenses Principles in Determining the Deductibility of, Here are some common examples of 100% deductible meals and entertainment expenses: A 100% deduction can be claimed for meals and entertainment expenses if the expenses meet any of the following criteria:

Tax Treatment for Entertainment Expenses What Is Tax Deductible?, Here are some common examples of 100% deductible meals and entertainment expenses: After tax reform, such expenses for amounts paid or incurred after dec.

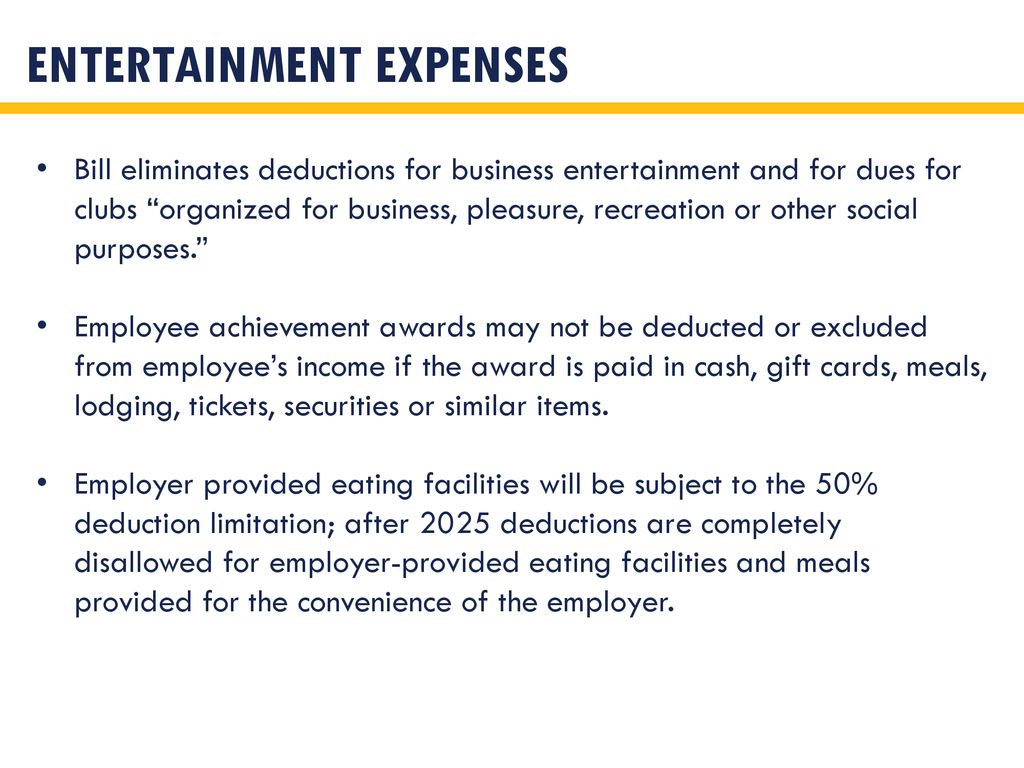

Tax Treatment for Entertainment Expenses What Is Tax Deductible?, In final regulations , the treasury department and irs clarified business expense deduction disallowances under irc section 274 for entertainment and food or beverage expenses. The act modifies section 274 by making all entertainment expenses, including facilities used for such activities, nondeductible, even if these expenses directly relate to, or are.

Which Client Entertainment Expenses Are Tax Deductible?, They are treated as taxable employee. Entertainment expenses are now generally nondeductible, whereas before the tcja, they were 50% deductible.

Tax Treatment for Entertainment Expenses What Is Tax Deductible?, This includes costs related to. Entertainment expenses are now generally nondeductible, whereas before the tcja, they were 50% deductible.

Business Meals Entertainment Expenses What's Deductible? YouTube, Under the tax cuts and jobs act (tcja) that congress signed into law on december 22, 2017, these are now 50% deductible in tax years 2018 through 2025, and nondeductible. Entertainment expenses are now generally nondeductible, whereas before the tcja, they were 50% deductible.

A guide to entertainment expenses Beany Australia Online Accounting, What has changed with meals and entertainment deductions? You may, however, deduct the cost of food at an entertainment event if it gets billed separately.

Tax Treatment for Entertainment Expenses What Is Tax Deductible?, Food and beverages provided at an entertainment activity are considered an entertainment expense and not deductible unless the food or beverage cost is stated. Since the 2018 tax cuts and jobs act, entertainment expenses have generally not been tax deductible.

PPT Chapter 9 PowerPoint Presentation, free download ID526062, Under the tax cuts and jobs act (tcja) that congress signed into law on december 22, 2017, these are now 50% deductible in tax years 2018 through 2025, and nondeductible. Under the tcja and the final regulations, entertainment expenses are generally nondeductible, whereas food and beverage expenses are generally subject to.

The tax cuts and jobs act ppt download, The new tax regulations allow a 50% deduction on any entertainment, amusement, or recreation expenditure for the purposes of receiving customers,. Company parties are still fully.

The deduction for meals and entertainment (m&e) expenses has been one of the most broadly applicable opportunities for significant tax savings;